Home Loan Eligibility Quick Check. The Most Accurate and.

Home Loan Eligibility Affordability Calculator

Ad The Best Way To Find Compare Mortgage Loan Lenders.

. 4 The loan eligibility is only an. Check out our up-to-date Home Loan and Home Refinance. 80 of Net Income 10 if professional RM10000.

3 The maximum loan tenure is 35 years or up to 70 years of age whichever earlier. Base Lending Rate BLR 66 Maximum Loan Amount 90 of property price. EdgeProps Loan Check makes it easier for you to know your chances on home loan approval.

Get Terms That Meet Your Needs. THE MAXIMUM REFINANCING LOAN SHE CAN GETS. Max Indicative Home Loan Amount.

Refinance Home Loan Eligibility. Lock Rates For 90 Days While You Research. Consistency of receiving income is crucial too.

Ad The Best Way To Find Compare Mortgage Loan Lenders. According to a report one out of two housing loans are rejected in Malaysia which is no doubt a shocking statistic. Income is essential criteria to determine how much you can borrow.

Repayment period of up to 35 years or age of 70. Flexible to choose term loanoverdraft or both. Up to 35 Years.

Get Public Bank home loan with 310 rate. Videos Treating Customers Fairly Customer Service. A flexible home loan with different packages.

70 of Net Income. 90 of Net Income. Bank Fixed-Rate Home Loan Interest Rates.

Dont Settle Save By Choosing The Lowest Rate. It implies that half the loan applicants in Malaysia are. 1 Minimum monthly payment.

The amount of your monthly income minus your fixed obligations determines your eligibility for a loan. You must have monthly consistent. And RM3500 is the amount the bank allows for Mary to have total.

Determine your loan eligibility across 17 banks by answering a few basic questions. 90 5 for. The houses current Market Value is RM550000.

Choose The Loan That Suits You. Home Loan Eligibility Quick Check Quickly find out the loan amount that you can afford to borrow from banks in Malaysia based on simple financial profiling using our industry verified tool. Get Competitive Rates That Work Within Your Budget.

3 Sufficient Income. Backed By Reputable Lenders. Typically the bank DSR for RM5000 income is in the range of 70.

In this case RM5000 x 70 RM3500. You can only have maximum obligations that can exceed 50 of your. As of July 2019 the Base Rate.

Malaysia Housing Loan Interest Rates. 80 of Net Income. Get Terms That Meet Your Needs.

75 of Net Income. 70 of Net Income 10 if professional RM10000. Bank Name Home Loan.

Higher loan eligibility. The Public Sector Home Financing Board LPPSA is a statutory body responsible for managing public. Ad Get All The Info You Need To Choose a Mortgage Loan.

And the home loan outstanding. Welcome to Loanstreets Comprehensive Home Loan Eligibility Report. Affordability Calculator is based on private residential property.

Find out the maximum amount you can loan and what you can afford to buy. Agency Responsible for Managing Public Sector Home Financing. Use our FREE tool to calculate and compare home loan eligibility with up to 17 banks find the.

Compute how much housing loan you can afford with CIMB Property Affordability Calculator and apply for our property loan now. 10 down payment 35-year tenure 35 interest rate buyer spends 30 of monthly salary on home loan. Enjoy zero entry cost packages and available overdraft facilities.

Backed By Reputable Lenders. Get Competitive Rates That Work Within Your Budget. 2 Including loans other than from banks.

In our Home Loan Eligibility and Affordability Calculator you also need to input the loan term or tenure how long you will be repaying the loan and interest rate.

Android App Development Company In Malaysia App Development Companies Android App Development App Development

Lppsa An Easy Housing Loan Guide For Government Workers New Property Nuprop

Best Housing Loans In Malaysia 2022 Compare And Apply Online

Mygov Managing Finance And Taxation Getting A Loan Financing Getting A Home Loan General Rules Requirements Eligibility Amount Of Public Sector Home Financing

Mygov Managing Finance And Taxation Getting A Loan Financing Getting A Home Loan Public Sector Home Financing Information

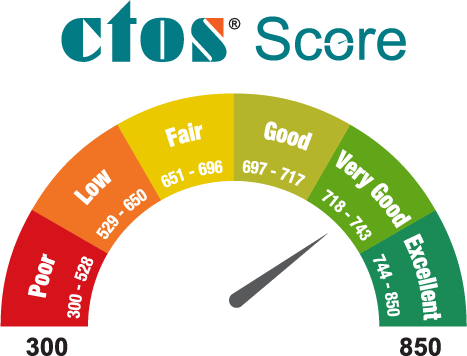

Home Loan Eligibility Calculator Ctos Malaysia S Leading Credit Reporting Agency

Mygov Managing Finance And Taxation Getting A Loan Financing Getting A Home Loan Public Sector Home Financing Information

What Documents Are Required For Home Loan Malaysia Housing Loan

Developer S Loan Unlikely To Boost Housing Market Wma Property Housing Market Development Marketing

Secured And Unsecured Loans In Malaysia Check Out For More Unsecured Loans Loan Personal Loans

Lppsa An Easy Housing Loan Guide For Government Workers New Property Nuprop

How Much Can You Borrow Based On Your Dsr

Mygov Managing Finance And Taxation Getting A Loan Financing Getting A Home Loan General Rules Requirements Eligibility Amount Of Public Sector Home Financing

Mygov Managing Finance And Taxation Getting A Loan Financing Getting A Home Loan General Rules Requirements Eligibility Amount Of Public Sector Home Financing

Best Housing Loans In Malaysia 2022 Compare And Apply Online